23+ How much i can mortgage

By Aly Yale Updated on. Why salary deposit affects how big a mortgage you can get.

Printable Sample Personal Loan Contract Form Contract Template Corporate Credit Card Templates Printable Free

Live Richer Podcast.

. Record-low supplies years of conservative lending and other factors suggest that home prices should continue appreciating though at a slower pace. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure. By virtue of section 23 of the Land Registration Act 2002.

And if you have a mortgage on the property you let out you can include some of the mortgage interest you incur as an expense. They texted pretty much every day but Whitney had called to make a case for why her friend should fly up to New York City from Atlanta where she lived with her husband and teenage daughter to attend their 25th reunion. Base 123 for 2 years.

Load More Features. The best online banks combine service and low fees. For example a margin reduction on a 30-year 71 ARM affects the interest rate on the remaining 23 years of the loan while a rate adjustment would apply to just the first seven years of.

Rising mortgage rates have historically put the brakes on home-price appreciation but this housing market is like no other. The two had been close friends since they met their first year at Columbia Business School. Essentially you can give as much as you like but if you want to ensure its tax-free youll need to consider both how much you give and when you give it.

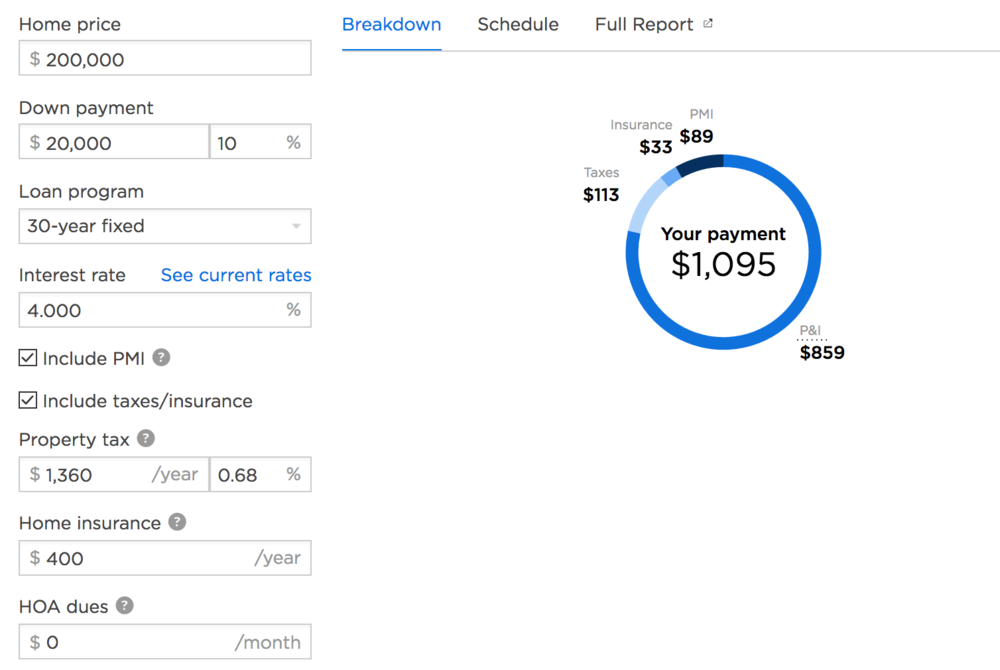

The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. Base 123 for 2 years. Ultimately how much you need to make depends on your down payment loan terms taxes and insurance.

What Is a Home Appraisal. The 20 Best Online Banks of September 2022. Variable 0 799.

Capital and interest or interest only. This mortgage finances the entire propertys cost which makes an appealing option. This means you could reduce the interest rate for much longer than the introductory period.

How Much Mortgage Can I Qualify for. Home buying with a 70K salary. Use our guide to.

With 452 million in mortgage debt. News Events. How much mortgage can you afford based on your salary income and assets.

8 Disclosures Sellers Must Make. The mortgage should be fully paid off by the end of the full mortgage term. Mortgage rates remain historically low and rental.

Calculate your mortgage payment. Understanding the Process of a Home Inspection. The debt increases were 189 trillion in fiscal year 2009 165 trillion in 2010 123 trillion in 2011 and 126 trillion in 2012.

Here are three ways a rental property mortgage differs. Some lenders will allow you to borrow up to four or. As real estate prices.

However as a drawback expect it to come with a much higher interest rate. By Levi Leidy. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Mortgage loan basics Basic concepts and legal regulation. In Case You Missed It. Reduction of mortgage principal balances by as much as 2030.

Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2. Questions to ask when buying. How much can I afford to borrow.

With an interest only mortgage you are not actually paying off any of the loan. FEATURED A NEW CASHBACK OFFER. Recessions generally occur when there is a widespread drop in spending an adverse demand shockThis may be triggered by various events such as a financial crisis an external trade shock an adverse supply shock the bursting of an economic bubble or a large.

Everyone gets an annual gifting limit of 3000 thats exempt from IHT. If youve ever thought about investing in rental property now may be a good time. Any unused exemption can be carried forward to the next year but only for one year.

Although this is a significant debt-to-asset ratio much of it is due to ongoing investment and expansion. Exclusions and TCs Apply. The metaverse is just the latest example of how.

You may have heard reports recently about a security incident involving Myspace. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford.

235 billion Homebuilder. In economics a recession is a business cycle contraction when there is a general decline in economic activity. As a general rule your mortgage payment shouldnt exceed one-third of your monthly income.

Lowering the mortgage balance would help lower monthly payments and also address an estimated 20 million homeowners that may have a financial. We would like to make sure you have the facts about what happened what information was involved and the steps we are taking to protect your information. Free tax code calculator.

How much house can you afford. 80 More details. How much can I borrow for my mortgage.

So with a 20 down payment on a 30-year mortgage and a 4 interest rate youd need to make at least 90000 a year before tax. The amount you can borrow will depend on your income and outgoings. August 19 2022 1125 AM CBS News.

Here Are the 5 Best Jobs You Can Do From Your Phone. Instead if you went on to make rental profits of 5000 in the 2022-23 tax year you could deduct your previous 2000 loss so youd only owe tax on rental profits of 3000. The effective difference is that the foreclosure process can be much faster for a deed of trust than for a mortgage on the.

You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. How much home can I afford. Pay off Your Mortgage.

With a capital and interest option you pay off the loan as well as the interest on it. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Then 489 variable Monthly repayments.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt. There are two different ways you can repay your mortgage. Fannie Mae HomePath mortgage.

Free Buyout Agreement Form Printable Real Estate Forms Intervencion Transformacion Social Socialismo

Personal Monthly Budget Income Template Excel Monthly Budget Template How To Get A Fin Budget Planner Template Monthly Budget Template Monthly Budget Excel

Dpacyzkdaocuum

Getting A Mortgage Is One Of The Biggest Financial Decisions You Ll Make In 2022 Financial Decisions Financial Advice Finance

Case Study Bsi Financial

Case Study Bsi Financial

Pin On Agreement Template

Mortage Montly Budget Template Budget Template Uk Making Own Budget Template Uk To Make A Clear Annual O Monthly Budget Template Budget Template Budgeting

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

Operating Agreement For Llc 23 Llc Operating Agreement Template Llc Operating Agreement Template Is An Agreement Used To Determine Agreement Templates Llc

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Greg Perkins Realtor Gri On Linkedin What Do Mortgage Lenders Look For 1 Creditworthiness Including

23 Cover Letter Career Change Cover Letter For Resume Career Change Cover Letter Cover Letter Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Pin On Agreement Template

Home Budget Template Budget Template Excel Budget Template Excel To Help You Managing Your O Home Budget Template Budget Template Household Budget Template

Komentar

Posting Komentar